The global economy is currently a tale of two recoveries, one East and one West.

The East

China’s economy continues its full-throttled recovery after successfully suppressing COVID, and travel, mobility and consumer patterns are rising and approaching prior year levels. India, where COVID cases increased uncontrollably in June/July, has set itself on a course of herd immunity, lifting all national restrictions as of September 1. “Unlock 4” allowed students to take exams and bars, restaurants, hotels and travel across the country reopened. COVID cases spiked, but have peaked as of the last week of September and are now trending down.

The West

In contrast, COVID cases in the US and Europe continue to rise as new waves take hold. Cases in the US have surpassed 80K per day and Europe is in the midst of rising numbers (France +50K as an example). Despite the high case counts, hospitalization rates haven’t risen nearly as high as the peak period in March/April, likely because of who is getting sick (demographically younger people are becoming sick), viral mutation, and geography (population density/viral load). Consequently, not as many patients are being admitted to hospitals as before, and those who are, are seeing better outcomes with improved treatment plans. Nonetheless, while the intensity of the hospitalization flows aren’t as high, the volume is still concerning.

To curb infections, however, lockdowns and restrictions are on the rise. Most of these lockdowns are at the city or county/regional levels as the appetite for national lockdowns have waned given their economic tolls. Even with these targeted approaches, we’re still seeing COVID fatigue as mobility hasn’t fallen as much as anticipated and rioting has occurred. It’s a footrace now between rising case counts, the need for lockdowns and the advancement of vaccines. We believe in a few more weeks the vaccines will win. Let’s explain why.

Vaccine Developments

As we anticipated, incentives matter, and they’ve certainly spurred our scientific community to respond. In contrast to the myriad of opinions earlier this year, we wrote the following in March:

“Government institutions, public/private companies, NGOs, healthcare providers, innovators and thought-leaders worldwide are almost singularly focused on developing treatments and vaccines to combat the virus. Their motivations to do so and attendant rewards are immense. Many have argued with certainty that no current treatment is a panacea and that a vaccine will take 12-18 months, fair enough, but breakthroughs and advances are much more likely when timelines accelerate as regulations relax . . . . Politically there’s an effort to manage expectations, but the private reality is pushing everyone to exceed them. We simply don’t know, but if our options are to trust in the innumerable scientists who do and who are working tirelessly on corralling this virus then our money is firmly on the scientists. Blind optimism? No. It’s an asymmetrical bet on human incentives, and in incentives we trust.”

Boy that bet sure is likely to pay off soon. According to the Milken Institute, there are more than 300 therapies and 200 vaccines in development. From a therapeutic standpoint, increased experience, steroids, anti-inflammatories and antibodies have all benefited patient outcomes, and new therapies will be approved shortly. Gilead’s (NASDAQ:GILD) remdisivir was recently approved, and more will shortly come-online (IV (in-patient) and non-IV shots (out-patient)).

On the vaccine front, we have 9 candidates in Phase 3 trials globally, one or two of which should be approved before year-end. Vaccine approvals are a matter of when, not if, and we’re about 6-12 months ahead of where consensus thought when this started. We anticipate Pfizer (NYSE:PFE)/BioNTech’s (NASDAQ:BNTX) vaccine will be the first approved in the US and AstraZeneca’s (NASDAQ:AZN) vaccine in the UK/EU.

Q1 2021, the End of the Pandemic

Here’s where we differ from the consensus. We believe the pandemic will end more quickly than the consensus believes. If the vaccine roll-out proceeds as we anticipate, the pandemic should effectively be over by March 2021. The reason is because once the vaccines are approved, the solution to our global pandemic shifts from scientific issue to a logistics challenge (manufacturing speed and distribution), which is easier to solve. It’s akin to a series of rivers being gated by dams. As each approval is granted, a barrier is removed and the water/vaccines can rush to the populace. Whether it takes the agencies one or two months matters less than how quickly drug manufacturers have been (or will be) producing the vaccines because eventually that’s what will dictate how fast developed and emerging markets will recover.

Although market watchers are analyzing Pfizer’s announcements today, and trying to determine whether efficacy data will be approved before or after the election, we think investors should look beyond that. Pfizer’s CEO has already expressed “optimism” that the data should be positive, and we anticipate that an Emergency Use Authorization will be granted before year-end. On the other side of the pond, the National Health Service in the UK have begun informing its hospitals to begin setting-up a vaccination program for front-line healthcare workers in December, a positive indicator that the AstraZeneca/Oxford vaccine is safe and efficacious (why else dose your most critical healthcare assets?).

What’s more important here is that drug developers have already begun manufacturing and stockpiling vaccines. They’ve done so at risk, funded by governments and private enterprises (e.g., Gates Foundation). Although a few vaccines could fail in trials, at least some will succeed, and if so, we’ll have ready stockpiles of vaccines to distribute as soon as health authorities approve them. Goldman Sachs projects that globally we’ll have 500M doses of various vaccines by year-end. Credit Suisse forecasts 700M.

In the US, the ever-conservative Dr. Fauci estimates that we’ll have 100M doses by year-end and 700M doses by April 2021. Many of the vaccines require 2 doses, so even taking the 100M year-end figure, we’ll be ready to dose 50M Americans in Q1 2021. The US has a population of about 330M, but the US government plans to prioritize high-risk groups and distribute vaccines first to the elderly, healthcare professionals and those with comorbidities (40-45M) (“Tier 1”). 50M vaccines, meet your 45M Tier 1 group.

Those over the age of 65 account for almost half of all hospitalizations and 80% of the COVID deaths, and almost all have at least one comorbidity. So if the vaccines are even 50% effective (i.e., the threshold for FDA Emergency Use Authorization), this will dramatically reduce overall hospitalizations and deaths. If a large portion of the Tier 1 group receives the vaccine, then the pandemic quickly becomes a much more manageable endemic.

If we have 700M doses available by April 2021 (350M vaccines), we’ll be able to dose the entire population of the US before summer.

Global Vaccination

Outside the US, over 160 countries have signed onto COVAX, a purchasing pool administered by the WHO, which provides for the equitable distribution of vaccines between rich and poor countries. Governments sign-on to buy a specific quantity of vaccines at predetermined prices. High-income countries fund the downpayment for lower income countries, and all self-financing countries will have access to the vaccines for 20% of their populations (i.e., the estimated “high-risk” groups). After this threshold is reached, lower income countries can draw from the pool as they become available, and high income countries are asked to delay withdrawals until everyone has reached 20%. Some vaccines may be more suitable than others for a particular country as distribution challenges vary (e.g., some vaccines require two doses and refrigeration).

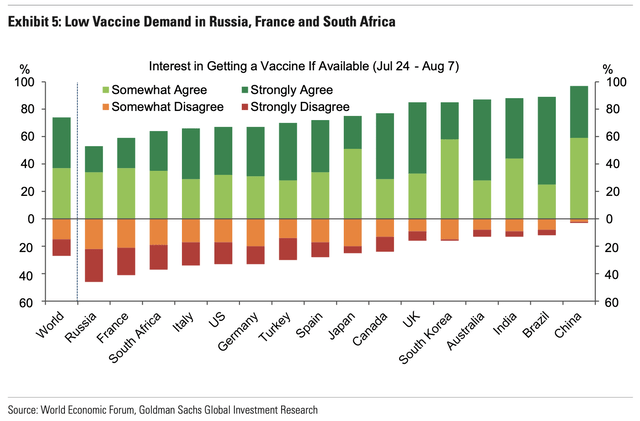

Since the US has a robust drug distribution system and didn’t join COVAX, our vaccination rates should be quicker. Based on survey data, however, we won’t come close to using our 700M doses (350M vaccinations), which means there’ll be an excess from the US (and most Western countries for that matter) for the emerging markets.

Emerging markets will take longer given their initial lower access to vaccines, but surplus vaccines and ramping manufacturing capacity should resolve the issues by Q2/Q3. Frankly, however, if we see hospitalizations and death rates drop significantly by Q1/Q2, we’ll know that this pandemic will already be fading. Lastly, people may not even wait that long to resume normal activity. COVID fatigue is already at a high and the political/societal pressure to reopen economies and return to “normalcy” means pent-up demand will recover even before “we all” get our vaccines.

Ultimately, the speed in which these vaccines have been developed is unprecedented, and after less than 9 months since the scourge blanketed the West, we’re on the verge of approving multiple vaccines. Note lastly that these are the initial vaccines. Johnson & Johnson (NYSE:JNJ), Moderna (NASDAQ:MRNA), Sanofi (NASDAQ:SNY), Novavax (NASDAQ:NVAX) and others are also testing their vaccines, which should roll out in 2021. Yet, as countries begin targeting their high-risk groups first in Q1 2021, this pandemic should be over. Although virulent, COVID is simply much more damaging and deadly for the elderly and those w/comorbidities.

With that backdrop, it’s time to explore “recovery trades,” sectors and industries that have been hard hit by COVID, but could see clearer skies by the summer and H2 2021. Let’s look at air travel.

Air Travel

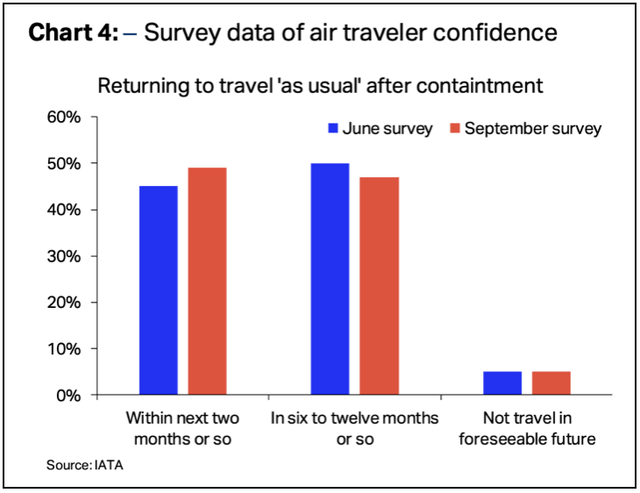

Given how we see vaccine development/deliveries above, we think air travel should begin recovering in the next six months. By H2 2021, we’ll see a material rise in flights and passengers returning. Why? Because of survey data like this one recently released by the International Air Transport Association (IATA).

Per the IATA, 95% of those surveyed said that they would travel by air within 6-12 months after the virus is contained. What’s more surprising to us? Half of these passengers said they’d do so within 2 months after containment. As the pandemic fades, domestic travel will be the first to rebound because of lower regulatory hurdles and pent-up consumer demand.

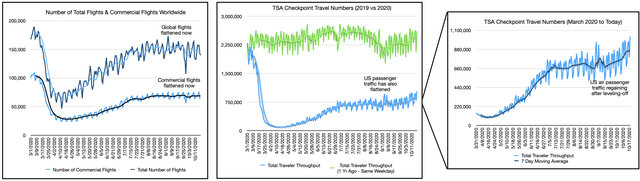

International flights, however, will depend on other countries opening their borders. This may take until H2 2021 when countries reach a certain level of vaccinations. As an interim, countries may create “air corridors,” whereby passengers who are tested before their trips can avoid quarantines (e.g., Hong Kong and Singapore). We surmise these initial regulations will serve as a template for international travel once a vaccine is released. Passengers may also need “proof of vaccination” if they want to avoid testing before traveling to another country. Currently, it sits well below pre-COVID levels, but US domestic air travel should continue ticking higher, and then vault materially higher by the summer, with international air travel to crawl back by H2 2021.

We’ve little doubt that air passengers globally will venture back in earnest once the vaccines are released. We’ve also long held that China is the world’s leading indicator on post-COVID recovery for consumer behavior. During China’s Autumn festival and week-long holiday in October, travel recovered to ~70% of prior year levels. Note that this is 9 months after China’s COVID pandemic, and does not include international travel as their borders are still closed. A robust recovery indeed.

Consequently, as we persevere through the next few months, with the election, COVID cases rising in Europe and the US, and the eventual inauguration, it’s important to keep in mind that our scientific community continues to run flat-out on developing vaccines and treatments that will eventually come to market. This pandemic will be over much quicker than many anticipate, which behooves investors to think through what a recovery can/will look like.

Recovery trades, whether in airlines, hotels, travel, food, etc. may be early, but will likely prove fruitful in the coming months. We’d recommend ETFs as a general way to play the recovery. For airlines, JETS should give investors a broad-based exposure to the industry, without needing to deep-dive the weakened balance sheets, or factor in the likelihood (or not) of fiscal help from the government. It includes both domestic and international airlines, and should provide sufficient coverage.

So as we enjoy our holidays (to the best of our abilities given these circumstances), shift your thinking. Know that things are and will get better. Be patient for a bit longer, stay healthy for much longer, and be amazed of what our scientists are about to achieve.

As always, we welcome your comments. If you would like to read more of our articles, please be sure to hit the “Follow” button above.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.